I received a phone call this morning from a potential buyer of a short sale. Our discussion turned to all the things that can go wrong in the short sale purchase process.

Here are some Q & A’s that were covered:

Q: Is buying a short sale a good deal for a buyer?

Sure! It can be. If it is a home you love, and a place you can see living, it’s a great way to buy a home. The positives of a short sale (vs. a bank owned/REO home) including:

- Disclosure: you’ll get disclosures from the seller which can yield some very helpful and important history of the property. Disclosures may include history of repairs, problems, remodeling, permit history, animals in the property, neighborhood issues, age and condition of the major components of the home including roof, heating and air, windows and more. The seller is NOT exempt from providing these disclosures and this can offer you important peace of mind.

- Maintenance: a seller is contractually bound to transfer the property in substantially the same condition as when you first saw it and wrote the contract. That means they should not let the lawns die, leave it unsecured, strip the property of fixtures or “trash” it. There are times however in financial hardship of a seller that they may not be able to maintain lawns/landscape or the home in general, so make it a negotiation item and try to assure the home won’t lose all it’s appeal during the process.

- Liability: the seller is still responsible for the property and therefore should confirm it is secure. We all too often see vacant homes for months eventually being broken into, vandalized or lived in by transients. The seller should assure these things do not happen during the process.

Q: Are there disadvantages of buying a short sale for a buyer?

Yup! There can be disadvantages too!

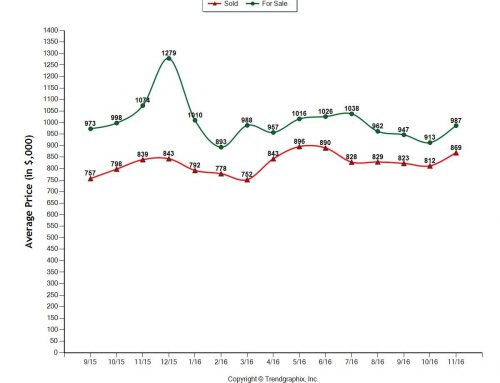

- Discount: this may be more perceived than anything, but there is NOT a substantial discount on short sales. They are typically listed and sold at market value for the area based on recently sold comparable data. The bank will do it’s own valuation (either a full-fledged appraisal, or a BPO/Broker Price Opinion) and arrive at a value they feel is appropriate. So don’t expect a short sale to be a “screaming deal.” Sometimes it may be depending on condition, timing, seasonal factors and more, but it’s not typically going to be discounted in any substantial way. The banks job is to get as much as possible, and that usually equates to the MOST the market can bear.

- Timing: yes, we’ve all heard about the long short sale waiting times. It is a fact of life with short sales that they can take a long time. Some longer than others. There are many factors that go into how long any particular short sale will take. Timing of the short sale, factors include some of the following:

- Who is the bank? Some banks have a time frame as short as 2 weeks (Wachovia), some work on a 4-8 week timeline typically (Chase, Bank of America, Citi, Wells Fargo). Still others have no timing guidelines at all and will let you know right up front they’ll get to it when they get to it (Aurora, Sun Trust). For this reason, there are some banks I simply won’t take on for a short sale.

- What kind of approval is needed? Can the servicer (the bank you’re dealing with) make the decision or will it have layers of investor or mortgage insurance approvals to go through? Is it in the HAFA short sale program? Do they already have an approval to be in the program, or just starting the process?

- Seller motivation: the key to a successful short sale is the motivation and hardship of the seller. The banks are none to thrilled with the idea of a “strategic default,” so find out the seller’s situation. Why are they short selling? Is it a bonafide financial or personal hardship? Are they being cooperative with their short sale and financial documents? Is the package ready to go?

- Agent experience: one of the biggest reasons short sales fail in my experience and observation is the sheer lack of experience of the agents handling the short sales. How many have they done? How many have they done with that bank? Have they started the process? (Almost ALL banks now allow you to start the process before you get an offer). How well do they understand the process? How proactive and ambitious are they? Who is negotiating the short sale? Do they hand it off to a third party?

- Costs: there are sometimes costs involved on the buyer side of the short sale. These can be from a few hundred dollars in ordering HOA documents if you’re buying into a community with an HOA, all the way to thousands in contributions to a 3rd party short sale negotiator, contributing to outstanding HOA balances (most banks will disallow large HOA debt in the short sale), purchasing your own home warranty (most banks will disallow the seller purchase of a warranty), etc. It’s important to remember, that though it is marked “seller paid” in your contract as per custom for your area, the bank reserves the right to approve (or not) any of those fees.

Q: What are some reasons that short sales fail?

While it is becoming less common for short sales to fail these days, they do still run the risk of being denied by the servicer, lender, investor or mortgage insurer. Here are some reasons a short sale may fail:

- Lack of cooperation of seller.

- Valuation problems i.e. bank wanting more money than the market can bear.

- Insurer problems – many lenders insured their mortgages, meaning they may get more in an insurance pay off than a short sale at market value.

- Other liens including home equity lines, or loans not interested in taking what the first lender will approve. This is becoming very common lately with the new laws in effect on second liens in California. In California, per SB458 if a second allows a short sale, they will give up any future right to pursue their deficiency with the borrower. If one is owed over 100k and offered 3k, does that sound like a good deal? No, it doesn’t sound like a good deal to these lenders either. They often don’t care if the first lender forecloses on that borrower, that leaves them free to pursue that borrower for many years into the future.

- Still other liens including IRS or state tax liens, contractor liens, personal debt, personal loans or others.

- Title issues, a title issue or lawsuit or lis pendens can all put a kibosh on a sale. This can include ownership complications between divorcing couples, out of country owners, etc.

- Timing issues can complicate a short sale if a seller just simply waited too long to ask for a short sale. Many banks simply will not delay a foreclosure date if it’s already been put off time and time and time again. Sometimes sellers tried everything for loan modifications, or bankruptcy, or for other reasons and many banks have guidelines in terms of the timing and the number of times they’ll delay that foreclosure sale.

Q: Can I still have inspections if I’m buying a short sale?

Absolutely! And you should! Every buyer should buy a home subject to inspections. While almost all short sales will be sold “as-is” and with no repairs or reports paid for or provided by seller, that doesn’t mean a buyer shouldn’t do their own. In California, it’s common that your escrow time frames and time frames for inspection will not start until the bank approves the short sale. That means you’ll have time to get any of the inspections you want to get, and to do all your due diligence. If something unforeseen comes up, something you can not overcome (i.e. foundation issue, drainage problems, retaining wall or slope/soils issues), termite infestation with a large bill for remediation, structural problems – then you can cancel. We’ve had some success with some banks reducing the price in consideration of BIG issues, but they almost never will credit for repairs, or allow repairs to be made. You can appeal for a lower price with multiple estimates, then take it as-is if they agree.

Q: Can I still cancel after the approval if I change my mind?

While yes, technically you have time frames for due diligence (as mentioned above) PLEASE do not waste everyone’s time by just “changing your mind.” Don’t wait until the approval has come in to decide you don’t like that area. Or don’t like the color of the paint in the living room. Or don’t like that it doesn’t have a pool. These are all things you should’ve known and seen when you wrote the offer. Cancellations should be reserved for good faith reasons including those unforeseen inspection issues named above. Most banks will make a seller start the process again from near square one and it simply isn’t fair to tie up a property for weeks or months if you’re not sure you even want the property. Don’t write offers on multiple homes just seeing which will come back first – that’s not good faith – unless you intend to buy all the homes.

Q: Will I have to deposit money into escrow right away?

Our California contract leaves this issue to negotiation. Buyers often prefer to not enter money into escrow until the bank approves the short sale. But be aware, due to many flakey buyers (as described above) many agents are starting to ask for that earnest money deposit up front at the time the contract is ratified between buyer and seller, and well before the bank approves it. If you’re uncomfortable with this, perhaps you weren’t sincerely dedicated to this home. It’s time to move on to one you are committed to. It’s just too much work for all involved just have it all fall apart on a whim later.

So, that’s it in a nutshell! Any questions about the short sale process? Just ask!

Catherine Myers

Windermere Bay Area Properties

(925) 683-2125

DRE 01337828

Walnut Creek, CA

Serving home buyers and home sellers in Contra Costa; Walnut Creek, Concord, Clayton, Pleasant Hill, Martinez and beyond!

Leave A Comment

You must be logged in to post a comment.