Short sale tax relief deadline is looming!

Is it too late to do a short sale to be sure you get the protections of both the State of California and Federal IRS tax forgiveness protections? Short sale tax relief is due to expire at the end of 2012.

Almost! If you are thinking of a short sale, now is the time! Most banks are approving their short sales within 4-5 weeks. Most buyers can close within 30 days after that date, so we are cutting them close. But, it’s not too late.

Starting a short sale NOW is key to being done by the end of the year. We hope that the tax protections will be extended with the IRS before the end of the year, but with an election year, no one knows what will happen. California state lagged behind the federal guidelines for several months the last time, so it’s possible there will be a period of time these two protection laws will not align.

You still need to have a hardship of course. Banks look closely at the reasons WHY you are doing a short sale and aren’t too keen on “strategic defaults.”

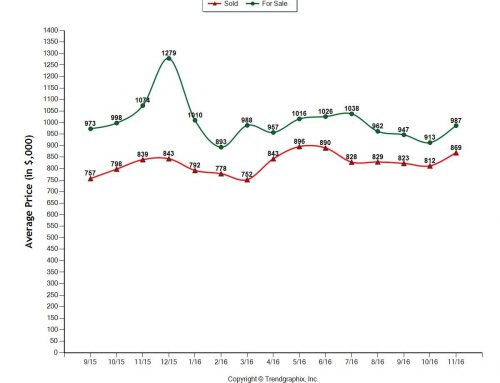

Call Catherine Myers, real estate broker as soon as possible to get started on a short sale now. Besides the looming tax protection expiration, this is a good time of year to sell. As we get closer to November holidays and into December, the market in general will take a general slow down. Further, we’ve been talking a lot lately at the supply and demand of our housing inventory now. We are seeing multiple offers on almost everything we list, so NOW is the time to capitalize on the market conditions too.

Catherine Myers

Real Estate Broker

Windermere Bay Area Properties

Serving Walnut Creek real estate and Concord CA homes for sale market

925-683-2125

Specializing in short sales in Contra Costa!

Leave A Comment

You must be logged in to post a comment.